In one of my very favorite books, given to me by a friend who knows of my love for the era known as The Great Depression, the subject of frugality arises often. The book, How to Cook a Wolf , written by MFK Fisher, is described on the back cover as being:

Written to inspire courage in those daunted by wartime shortages.

The book, written by what seems to be a quite well-off woman well-versed in frugal living, shares the joy in living a frugal life and practical tips for doing so. You see, up until the early 1900’s, frugality was “normal” in America. It was the way of life. Phrases such as waste not, want not were commonplace in homes. To drive home the magnitude of the differences between life in America now and life in America 100+ years ago, let’s look at some statistics:

Consider this information from The American Mortgage in Historical and International Context:

In 1949, mortgage debt was equal to 20 percent of total household income; by 1979, it had risen to 46 percent of income; by 2001, 73 percent of income. -Bernstein, Boushey and Mishel, 2003

Before the Great Depression, the single-family home mortgage was a very different instrument. Until the 1930s, residential mortgages in the United States were available only for a short term (typically 5–10 years) and featured “bullet” payments of principal at term. Unless borrowers could find means to refinance these loans when they came due, they would have to pay off the outstanding loan balance. In addition, most loans carried a variable rate of interest. Bartlett (1989) presents a fine historical overview of the origins of the modern U.S. mortgage. Home mortgages typically had very low loan-to-value ratios of 50 percent or less and thus did not, by themselves, place substantial stress on lenders, because when borrowers were short of cash, their property could be sold if necessary to redeem their loan.

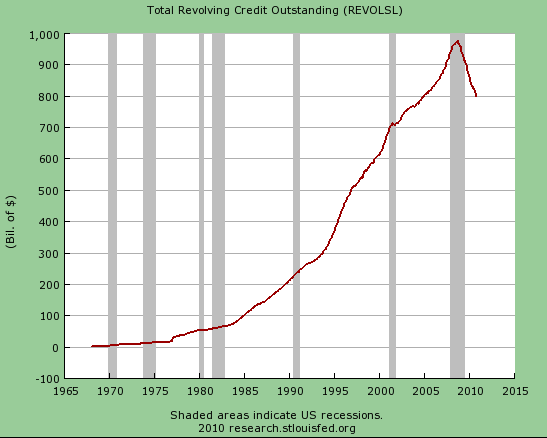

The times have changed, as you well know, regarding the use of credit card debt in America as well. Consider the following graph:

If the above graph isn’t a sign of how things have changed in America, I’m not sure what is.

One of my favorite stories from How to Cook a Wolf shares when the author’s grandmother participated in a group in which young housewives shared what they had learned about frugal living. I’ll share the smirky story with you now:

Once during the last war (World War 1), when rationing of sugar and butter had been in effect just long enough to throw all of the earnest young housewives into a proper tizzy, my grandmother sat knitting and listening to a small excited group of them discuss with proper pride their various ways of making cake economically. Each felt that her own discovery was the best, of course, and insisted that brown sugar or molasses-with-soda was much better than white, or that if you used enough spices you could substitute bacon fat for butter, or that eggs were quite unnecessary.

Finally, my grandmother folded her knitting, and then her hands, which was unusual for her because she believed that no real lady’s fingers should ever be idle. “Your conversation is very entertaining, indeed.” she said with somewhat more than her ordinary dryness.”It interests me especially, my dears, because after listening to it this afternoon I see that ever since I was married, well over fifty years ago, I have been living on a war budget without realizing it! I never knew before that using common sense in the kitchen was stylish only in emergencies.”

This epic paragraph, in my mind at least, clearly states the differences between life in America now and life in America 100+ years ago. Somewhere along the line we have forgotten to be wise, frugal and reserved in how we live our lives and spend our money.

This is not a “slight” to the “others” – our family is equally guilty of abandoning common sense regarding our finances in exchange for I’m-not-sure-what. Maybe instant gratification? Maybe a lack of priorities or goals?

I don’t know, but somewhere along the line we have forgotten to include frugality as a normal part of the American life. Each new decade starting after the end of the Great Depression saw its own “new” way of living.

The 50’s and 60’s ushered in the first common use of the credit card. Although then, credit cards were reserved for the proven wealthy, I think a change in lifestyle was started here that eventually trickled down to every American.

The 70’s saw the invention of the two-income family, but that extra income did little for the prosperity of the American people.

I talk here about the worst financial advice I’ve ever received when the bank I worked for was promoting their credit cards with the slogan:

Better living through plastic

This was in the very beginning of the 1990’s, which followed a slew of other alarming statistics from the 1980’s that should’ve been a warning bell that something serious was happening to the money management system of the American individual:

- A decline in the savings rate

- The increase in advertising

- The increase in stock values

- The increase in real estate prices, college education costs and government debt

- Increasing cultural acceptance of debt as a way of life

- Stagnant wages

- A decline in financial literacy

- An increase in consumer bankruptcies

*Source: American History USA

Somewhere along the line, we’ve abandoned frugality for a “better” way of life that, ironically, has done little but damage our quality of living, and I find this fascinating. And sobering.

The roaring twenties was also a time of reckless abandon and que sera sera thinking when it came to money management, and the crap seriously hit the fan following the October stock market crash known as Black Tuesday.

What followed was a good decade and a half (and some say even longer) of serious trials and tribulations during the period known as The Great Depression. As I watch our governmental debt rise and our consumer debt remain steady at a lofty 3.2 trillion dollars, I wonder how the people of our grand country would fare if a serious economic meltdown hit our shores once again.

I worry about this quite a lot, honestly, and that worry is a catalyst for us as we continue to pay down our consumer and mortgage debt and work to practice frugality on every front. We’re definitely a work in progress and we’ve got a long way to go, but we’ll get there – because we have to. Failure is not an option, as Ed Harris said in Apollo 13. Won’t you join us? Let’s make frugality once again stylish. Let’s make paying off debt the new, cool thing to do and abandon the fruitless efforts to keep up with the Joneses. You in?

We are so guilty of waste. When I was little my grandpa saved everything and repurposed it. He was incredibly crafty. So much has become a lost art form. I can’t even sew myself! It’s not that we have to go backwards in time and live like pioneers, but we can take the lesson of mindful spending at the very least.

I totally agree, Tonya!! We need to learn more from our forefathers and foremothers – they have so much to teach us!

Before we glorify the frugality of not owing a mortgage due to being able to pay off the house quickly, the reason there were no such things as a 30 year mortgage back then is because only the wealthy owned homes. Back then, it was normal for families to live in tenement housing and/or single-room-occupancy apartment complexes in urban environments. Those in the country might be sharecroppers or renters in small homes.

I agree that people are much more wasteful today, especially in today’s disposable society. I also agree that people are too eager to finance everything. But to glorify the lack of mortgage opportunities of the 19th century is not something I’d agree with.

Ironically though, as many people who are tied to major debts know first-hand, those financial freedoms, such as $0 down mortgages and easy access to financing everything, can make someone as poorly off as those living in one room tenement houses from yesteryear. There does need to be a middle ground.

Thanks for sharing your thoughts, Tara. Appreciate it!

I’m in! This is a great article and this topic inspired one of our most popular posts, the Live Like Grandma Challenge: http://www.pretendtobepoor.com/grandma-challenge/. Framing it is returning to a one-normal lifestyle makes it seems more doable in my opinion.

Thanks for sharing the link, Kalie! Can’t wait to read this again!!!

Being frugal now in days is much harder than it was back then. It was fashionable and easier to avoid all the advertising that we come across on a daily basis. We are subjected to the new and the must have everyday, by the people we meet, the places we go and the things we see on tv. If I could avoid them all, there would be less turmoil as to what to buy and where my money should be going.

It definitely takes a lot of self-control to be frugal in today’s world. For us, moving out of the city taught us that not “everyone” lives to keep up with the Joneses. What a freeing revelation that has been!

I’m in – but it sure is difficult, huh! One really needs to prioritize and change your thinking / actions. Cuz paying off debt, and living UNlike everyone else is hard to do. Keep at it Laurie!

It’s definitely difficult! I think if we all ban together it would help lots, though. Like a support group for the frugal-minded. 😉

I’m in! I love this line: “I never knew before that using common sense in the kitchen was stylish only in emergencies.”

I know – isn’t it a hoot? Cracks me up every time I read it. 🙂

Interesting stuff. I think that the only people I envy and/or try to keep up with are other frugal people. Even that isn’t necessarily healthy, since we have so many more health-related expenses than most bloggers.

I hear you, Abigail. It’s hard to not compare yourself with frugal people too. I think it’s great that you’re doing that as opposed to compare yourself with the Joneses – that would have much worse effects on your finances!

Very timely post. My wife & I talk about this a lot as we build our house. Sadly we live in a throw away society & we are thinking of ways to teach our children how to embrace “quality” instead of “quantity.” Our only child is 5 months old, so thankfully we have a head start!

Josh, that’s so awesome that you guys are having those talks now. The older our children get (we have four) the more we realize the value of experiences and time spent together over “stuff”.

I am trying to get better about waste and throwing stuff out. I am much approved but still have room for improvement. I would not want to return to that era but I do think people need to become better consumers versus just consuming. And like you, I was guilty of the former for quite some time.

I hear you on people needing to get better. The more we sit and really think about what’s important to us, the less it involves buying “stuff”. 🙂

Wow, that graph is truly eye-opening. I guess I never knew that prior to the 1970s what we now know as consumer debt did not even really exist! That is super crazy considering that was NOT that many years ago.

It’s amazing, isn’t it?? My parents never had credit card debt, largely because credit cards were still given out sparsely in the 70’s, but they did get a brand new car loan for 5k. I remember it vividly, for some reason.

I shivered when I read your bank’s logo: “Better living through plastic,” because it sums up so much about what I got wrong in my early twenties. I was a bank teller, pushing credit cards on people, when I took Financial Peace University and figured out what debt has done to America. Needless to say, that was the last time I sold a credit card offer to anyone. 🙂

It’s amazing how we fell for drinking the koolaid, isn’t it? The banks do such a wonderful job (to this day) of teaching employees that they are doing customers a favor by granting them credit. This is why it’s so important for us as consumers to educate ourselves in the area of personal finance.

Amazing the uptick in debt in the last 35 years, but looks like there is some hope with the downswing over the last few years. We all need to do our part. Makes me wish my grandparents were still around to understand how they did things back than.

I thought the same thing, Brian!

Oh, I certainly hope the downward trend continues. Time to buck the system and stop borrowing!

It really is a different world, but many people have made changes since the start of the Great Recession. I’m optimistic that we are starting to put less importance on acquiring things.

I hear you, Tre! Hopefully optimistic that the trend continues!

I’ve been thinking a lot about how life has changed since the 40s and how things would have to change in a rationing environment (Reading The Guernsey Literary and Potato Peel Pie Society while watching Home Fires will do that to you.)

We have a society of abundance and I think it would be really hard to adjust to true scarcity. Many of us have never learned the skills necessary. I’m trying to learn frugality, but I’m pretty glad it’s a choice and not a necessity.

This is why I really fear for our country. I fear that if a seriously big economic downturn came about, much of society would not be able to handle it. We’ve just gotten so used to abundance. Awesome comment, Emily. And I hadn’t heard of those books – I’ll have to read them!

So very true! In previous generations, saving and being frugal was normal but seems to be frowned upon nowadays. It seems like many people get caught up in the consumer mindset and try to keep up with the Joneses. I think that I’m frugal, but I can’t hold a candle to my parents or grandparents.

SO true!! My grandma worked at a fair paying job but had over 100k in regular savings by the time she retired. She simply didn’t buy. Things are so different now.

Great post! Luckily, we all have a place where being frugal is accepted – our PF community. Try discussing frugality in everyday life with people not a part of this community. Sure there are some who are comfortable with it, but most are not.

This is why the PF community has been such a blessing to me. They love frugal and the “frugaler”, the better! 🙂

It really is amazing how much things changed in a few decades!

Yeah, it sure didn’t take long to go from no debt to LOTS of debt, did it?

On Monday I went to Dunkin Donuts because they had coffee for a quarter and told a friend of mine who said, “what are you cheap?” It’s crazy to me that I make a smart money choice that I’m excited about and I still get called cheap. It doesn’t bother me though like it used to because I know that frugality is where it’s at. It just makes me sad for my friend and others that they waste so much money unnecessarily.

This is the culture I’m talking about!! It’s so uncool to be frugal. It’s fashionable in today’s world to spend with reckless abandon. We’ve somehow associated that with success. I’m SO glad we’re a part of the “frugality is where it’s at” crowd. Much more peace going on there. 🙂

Laurie, being frugal has been “in” for me since I paid off my student loan years ago. That’s the time I realize that I should be financially smart and responsible and build savings by being frugal. And, I am proud of those people who prefer to save and be frugal whenever possible.

Love hearing frugal success stories like your, Jayson. Way to go on getting those student loans paid off!

We have been reading the Laura Ingalls Wilder books. I do love my modern conveniences, but it does make you wonder what happened to our sense of self preservation. Maybe it’s because we don’t have to work as hard as our grandparents and great-grandparents just to survive? There has to be a happy medium in there somewhere.

“It makes you wonder what happened to our sense of self preservation.” Exactly!!! It scares me, honestly, that we can’t do for ourselves as those in the pioneer days did. If we were ever put in a situation where we had to, most of us would be in big trouble.

My parents have always been extremely frugal, but it was normal back then. My mom didn’t have her own car until she was in her 30s! Nowadays people want everything right away.

It’s amazing, isn’t it? I mean, a one-car family was normal back in the day, now it’s frowned upon as strange.

Loved the historical perspective on this article. I think we are all learning that waste and excess are not only bad for the pocketbook but also bad for the environment.

Excellent read!

Thanks, Laura Beth! Glad you enjoyed the article. Thanks for stopping by! 🙂